Looking at the oasis on the ocean written by Liu Zinan, chairman of Royal Caribbean Cruises Asia, one of the words has attracted the author's attention: "it took 20 years for the US cruise market to reach the scale of 500000-2500000, while China only spent half of it."

There is an idea that the future of a certain market in China can be judged by looking at the history of similar foreign markets. The scale of China's cruise market has experienced 10 years from 500000 to 2.5 million, which is twice as fast as that of the United States. How to understand this speed?

1. The explanation of latecomer advantage

The explanation found in the search engine is that the late entrants gain a competitive advantage over the first mover because they enter the industry later. By observing the actions and effects of the first mover, we can reduce the uncertainty and take corresponding actions to gain more market share. For example: R & D cost advantage, industry risk control advantage and so on. In 1990, Lieberman and Montgomery pointed out that the advantage of latecomer mainly lies in three aspects

(1) The "free ride" effect of latecomers: latecomers may save a lot of investment in product and process research and development, customer education, employee training, government approval, and basic investment, but can benefit from it.

(2) The first mover locked in the wrong technology or marketing strategy: because of the uncertainty and "discontinuities" of technology and customer demand in the early stage of the market, the first mover often makes wrong decisions. The latter can learn these lessons from the mistakes of the first mover and do not make the mistakes that the first mover once made.

(3) Inertia of incumbents: due to the existence of sunk cost and rigid organization, enterprises are unwilling to introduce new products or improve products, and are unwilling to reform. As a catch-up, the latter always wants to seize the opportunity to replace the first mover, so as to carry out a lot of innovation on the organizational structure, technology and products of the enterprise, so as to occupy an advantage in the competition with the first mover.

According to the above logic, China's cruise market can avoid the detours that the U.S. market has gone through, reduce the exploration in the confusion, and use the marketing methods of the United States, so as to obtain a relatively rapid growth.

2. Is there a potential law?

However, from another dimension, can we not find the hidden rules of the cruise industry? In order to obtain rapid growth and complacent at the same time, the possible industry storm or market adjustment has come. In other words, the law is there. If we go fast, something must be wrong. The continuous accumulation of these problems may harm the long-term development of the whole industry.

In recent years, China's cruise market has entered the bottleneck period, adjustment period or the second platform period, which may be to repay debts for the market scale of rapid expansion in the past 10 years. In the marketing model described by Dr. Liu, in fact, no good path has been found from the United States. Instead, in the relevant exchanges with Taiwan travel agencies in China, the marketing model of "binding piles" has been found, which is very similar to the cement piles for oyster cultivation along the coast. Oysters grow on it, and oyster farmers harvest them regularly. This mode of cultivating channels has opened the initial scale of China's cruise market. But it's like opening Pandora's box, and there may be demons lurking behind the beautiful scene.

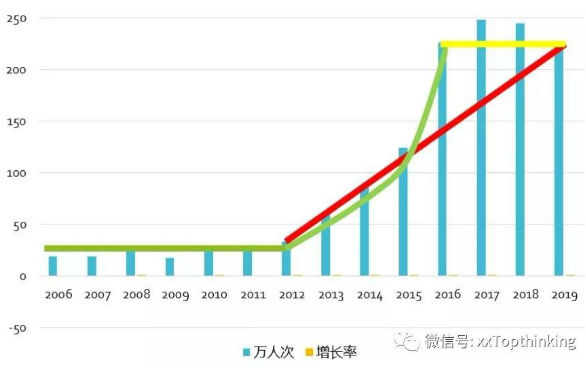

Observe the growth trend of China's cruise market in the past few years. In fact, China's cruise market has gone from about 500000 to 2.5 million, which was only four years from 2013 to 2017, which was a four-year rapid development. Although the scale has increased by about five times, it is unclear which companies are making money.

If we extrapolate from 2012 to 2015 as a straight line, we can see that the number of passengers increased by about 800000 in 2016, 800000 in 2017 and 450000 in 2018. It can be seen from this that the scale of 2019 is about 2.2 million person times. If tourists do not follow a straight line, will it be more likely to go forward? Cruise related supporting systems do not need to bear the excess pressure of excessive growth, will the industry appear more healthy?

Backwardness may be an advantage, a disadvantage, or nothing. Because there are no exactly the same two leaves in the world, and there won't be exactly the same two markets. China's cruise market and the U.S. cruise market also have many different influencing factors, resulting in differences between the two markets. The above comparison may be of some significance, giving more thinking dimensions to good thinkers. It may also be meaningless, because the two markets are completely incomparable.